FAQs

What is the meaning of a Loan Calculator?

EMI calculator can assist you with sorting out your regularly scheduled installments on various kinds of Loans. These incorporate home loans, vehicle advances, commercial loans individual credits, etc. They can likewise assist you with understanding the amount you can afford to borrow based on your income and other factors like age, etc.

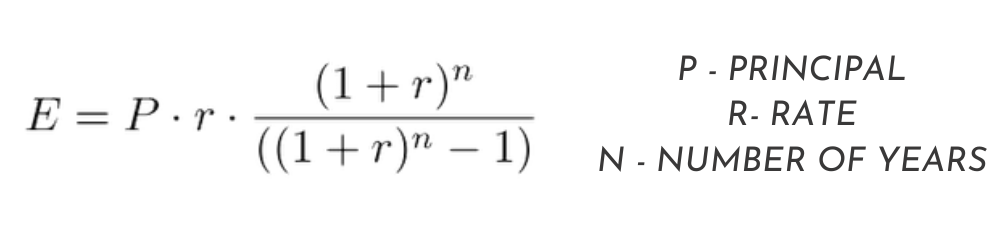

What is the mathematical formula to calculate EMI for a particular loan?

What is the benefit of a Home Loan calculator?

A Home Buyer can utilize a loan calculator to look at current interest rate offers from various banks. The outcomes show the complete expense of getting along with each EMI. This will assist with reducing the most ideal choices for clients and applying for a loan that accommodates their particular requirements and plan better.

Is it beneficial to opt for maximum tenure for a loan?

Tenure of any term loan is linked to the age of an individual seeking loan and also the policy of the financial institution. Whilst it is beneficial to take a longer duration to keep the monthly obligation lower, it is also a fact that higher tenure means higher amount of interest servicing during the tenure of the loan. So there has to be a balance which should be worked out with the help of a professional considering future obligations also.

Which option is better - fixed or floating rate of interest?

Rate of Interest gets impacted by several Micro and Macro economic factors. Many of those are non predictable. Floating loan rates are usually 50-100 basis points higher than Fixed rates. One should opt for Floating rate if there are chances of rates moving southwards in the near future and vice versa.

The results provided by the EMI calculator are for informational purposes only. Actual loan offers and interest rates may vary based on the lender's policies and your creditworthiness.

Explore

Quick Links

Get in Touch

Address : Lodha Supremus, B-307, Wagle Estate Rd, near New Passport Office, Wagle Industrial Estate, Thane West, Thane, Maharashtra 400604

Copyright © 2023 All Rights Reserved