Many borrowers believe that when the RBI cuts the repo rate, their home loan EMI will automatically reduce. In reality, the impact is not always immediate.

Banks and lenders may:

If your EMI has not reduced despite falling interest rates, it may be time to review your loan strategy and calculate your options.

A home loan balance transfer allows you to move your existing loan to another lender offering a lower interest rate.

You should consider this option if:

Using a Home Loan EMI Calculator , you can compare your current EMI with the revised EMI and estimate total interest savings before making a decision.

Balance transfers are usually most beneficial during the early or middle years of the loan.

Part prepayments directly reduce the outstanding principal, which lowers either the EMI or the remaining tenure.

Best practices include:

Even small annual prepayments can lead to substantial interest savings over time. An EMI calculator can help you estimate the exact impact.

If your income has increased, consider raising your EMI slightly instead of keeping it unchanged.

This helps:

You can use an EMI calculator to test different EMI amounts and see how much interest you can save.

Before opting for a balance transfer, you may request a rate revision from your current lender.

Options include:

Even a small reduction of 0.25%–0.50% can significantly lower your EMI. Use a calculator to estimate the benefit before applying.

If your loan was taken before October 2019, it may be linked to MCLR or base rate.

In such cases:

Repo-linked loans adjust faster to RBI rate changes and offer better transparency.

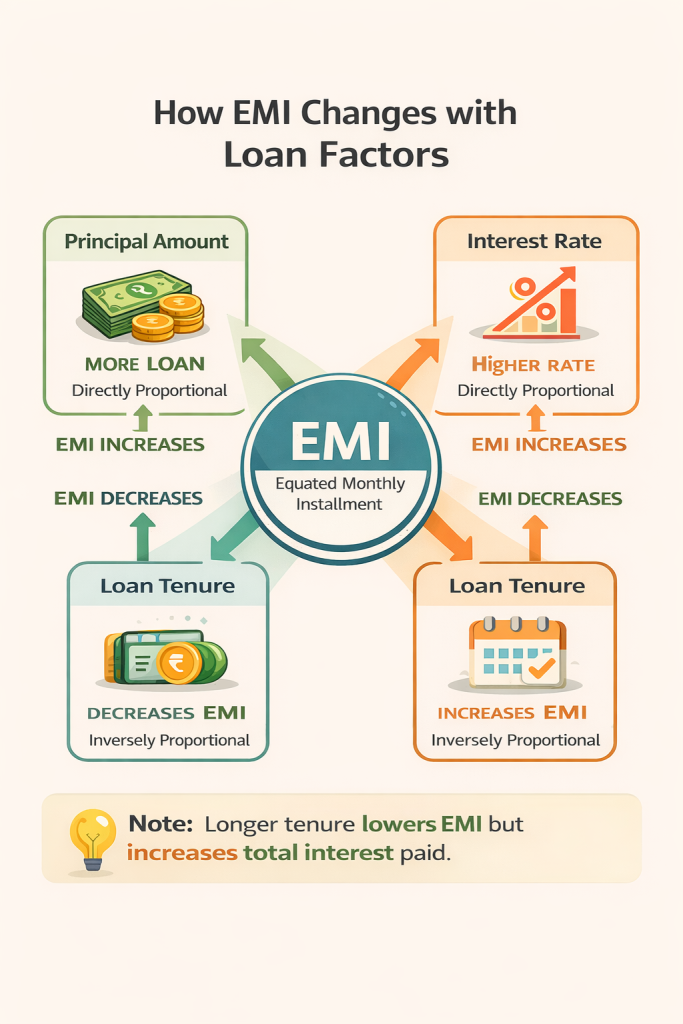

Even a small interest rate change can make a big difference over time.

For example:

An EMI calculator helps you compare scenarios such as:

Instead of keeping extra funds idle, consider:

Regular surplus management helps reduce both EMI pressure and total interest.

Your credit score directly affects the interest rate offered by lenders.

To improve your profile:

A better credit score improves your chances of negotiating lower interest rates.

If your loan is with an NBFC:

Switching to a bank could result in lower rates, but always compare EMIs, tenure, and total cost using a calculator.

Lowering EMI is helpful for cash flow, but it may not always be financially optimal.

Avoid reducing EMI if:

In many cases, keeping the EMI constant and reducing tenure results in higher long-term savings.

Managing your home loan effectively helps you:

Regularly reviewing your loan using an EMI calculator ensures you make informed financial decisions.

Before restructuring or transferring your loan:

Small adjustments today can result in significant long-term savings.

Lowering your home loan EMI requires a proactive approach. Options such as balance transfer, part prepayments, repo-linked conversion, and interest rate negotiation can reduce both your monthly burden and total interest.

Instead of waiting for automatic rate benefits, review your loan periodically and use an EMI calculator to evaluate different scenarios. With proper planning and informed decisions, your home loan can become more affordable and easier to manage.