Gold ETFs are having their moment in the spotlight. In June 2025, investor inflows into Gold ETFs jumped by an incredible 613%, reaching ₹2,080 crore—the second-highest monthly total in the segment’s history. This isn’t just a headline—it’s a sign that Indian investors are actively turning to gold for security, returns, and digital ease.

At EMI Calculator, we believe that understanding shifts like this can help you make better financial choices—whether you’re planning investments, evaluating gold loan options, or just staying informed.

📊 Use our EMI Calculator to plan your monthly investments and financial goals with ease.

Geopolitical Tensions Push Investors to Safety

Global uncertainty is a key driver. In 2025, ongoing conflicts and tensions are pushing people toward safer assets–like gold. Here’s what’s fueling that:

With this backdrop, it’s no surprise investors are turning to gold—and Gold ETFs in particular—for protection.

Central Banks Are Buying Gold Too

Global central banks are steadily increasing their gold reserves to reduce reliance on the US dollar. This builds long-term confidence in gold as an asset class, especially in digital forms like ETFs.

Lower Interest Rates Add to Gold’s Appeal

As inflation stabilises and rate cuts are hinted at by global central banks, non-yielding assets like gold become more attractive. Gold ETFs offer investors exposure without the hassle of buying and storing physical gold.

Inflation Isn’t Over – and Gold Still Matters

Many Indians still view gold as a hedge against price rise, even when inflation isn’t at its peak. ETFs make this easier and cleaner, avoiding concerns around purity and storage.

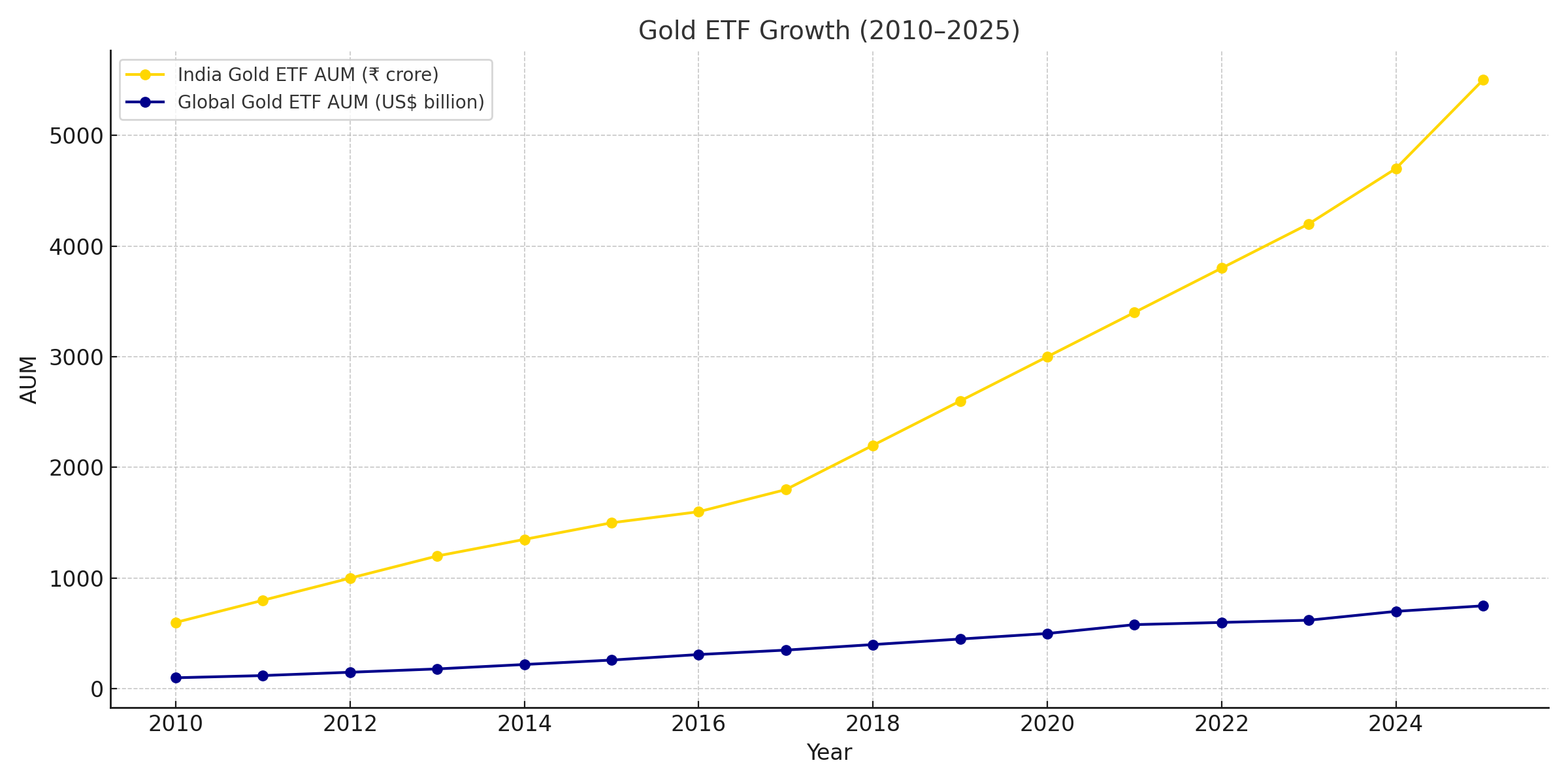

Gold ETFs in India: Record-Breaking Growth

June 2025 was a milestone month:

This shows a major shift toward digital gold solutions—ETFs offer liquidity, ease of access, and better transparency.

💡Planning a loan using gold as collateral? Compare gold loan interest rates with our Gold Loan EMI Calculator to make informed decisions.

Worldwide, Gold ETFs pulled in over $38 billion in H1 2025—the best in five years. Total holdings crossed 3,600 tonnes, with central banks in Asia and North America leading the pack. This global momentum is also driving domestic interest in ETFs across India.

While nothing’s guaranteed, market analysts see a few likely outcomes:

If things calm down significantly: Prices may correct by 12–17%

What Happens If Global Risks Cool Down?

Gold may be hot now, but what if things settle globally?

According to analysts, gold prices could dip by 12–17% if global tensions ease. Here’s why that might happen:

If you’re watching gold for your portfolio or loan plans, a potential correction isn’t necessarily bad–it could be a chance to invest at a better price.

At EMI Calculator, we always recommend balance. Gold ETFs are great for diversification. And if you already hold gold, you can explore a gold loan instead of selling—it keeps your asset while giving you the liquidity you need.

Use our calculators to:

Gold ETFs offer several advantages over physical gold:

Already own gold? You can use it for a gold loan without liquidating your investment.

Market Insight | What It Means for You |

Gold ETF inflows jumped by 613% | Investors are leaning on gold for safety |

AUM rose to ₹64,800 crore | Confidence in digital gold is growing fast |

Global ETF inflows hit $38 billion | Central banks and investors are betting on gold |

Gold demand rising despite jewellery sales falling | ETFs are becoming the preferred choice for gold exposure |

Gold is more than just a metal-it’s financial peace of mind.

Whether you’re planning your next investment or evaluating a loan against your gold assets, Gold ETFs offer a flexible and smart way to stay protected in an uncertain world.

Use our free tools at EMI Calculator to explore gold loan options, calculate EMIs, and make better financial decisions–without stress.

Let’s plan smarter, together.